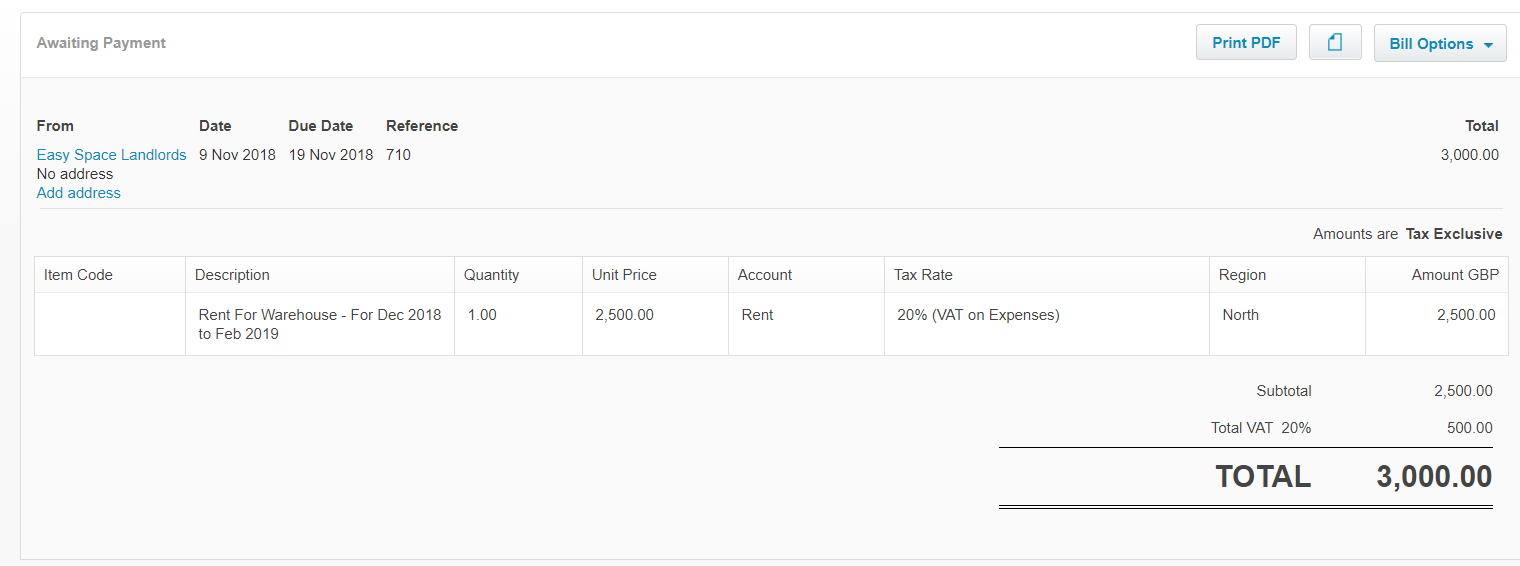

In this example, we have received a rental invoice in November, but it relates to the months December – February 2019.

Why spread the cost at all?

For an accurate Profit and Loss, we need this cost spreading across the months it relates to otherwise November’s rent will be too high, and Dec-Feb will be too low.

Here’s how you do it:

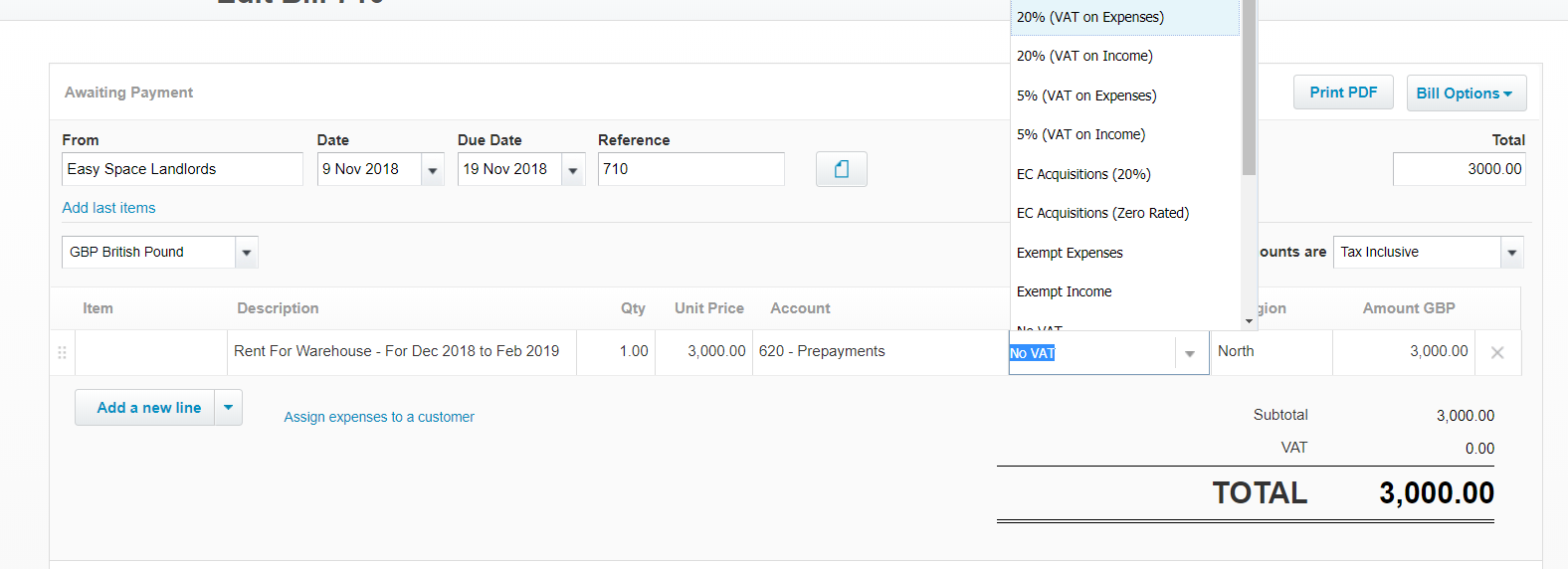

Step 1 is to post the Invoice to the Prepayments account instead of Rent as shown here.

Prepayments is a balance sheet account and not in the Profit and Loss at all – so the cost is taken out of the Profit and Loss.

Warning – when you do post to this code Xero may change the VAT so ensure you re-set the VAT rate to the correct value.

Once approved this invoice is now in Prepayments in the balance sheet.

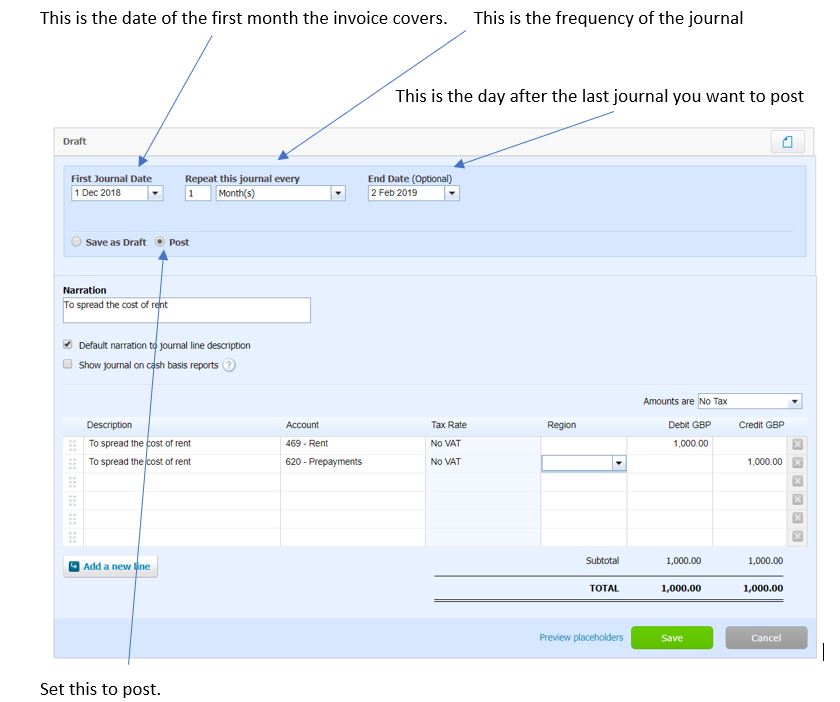

We know it relates to Dec to Feb – 3 months so now we need to move 1/3 of the net value from the Prepayments account to the Rent account this is £3,000 / 3 = £1,000 per month in Dec, Jan & Feb.

If this was a 12-month invoice we would move 1/12 per month.

This will bring the value of the invoice on the Prepayments accounts down and the value on the Rent account up.

You could do this with three manual journals dated 1st of Dec, Jan & Feb, but the quickest way to do this is with a repeating journal. Navigate to this in Xero by clicking on:

Accounting >>>>>>>>>> Manual Journal >>>>>>>>>> New Repeating Journal

When you save this journal it will post three journals to Debit Rent and Credit Rent Prepayment in the months December, January and February.

If the journal is in the past it will post this – in this case, we have received the invoice in November but the first journal isn’t until December.

The end date will ensure the journal won’t be posted forever.

By undertaking this process we are one step closer to more accurate management accounts.

For more help on Xero or event a FREE Xero review please contact us.