VAT penalties and interest charges are changing for everyone who will be submitting VAT returns for accounting periods on or after 1st January 2023.

The default surcharge is being replaced by a penalty system for submitting your VAT return or VAT payment late.

Submitting your VAT Return late

The new points-based penalty system means that for every VAT return you submit late, you will receive one late submission penalty point.

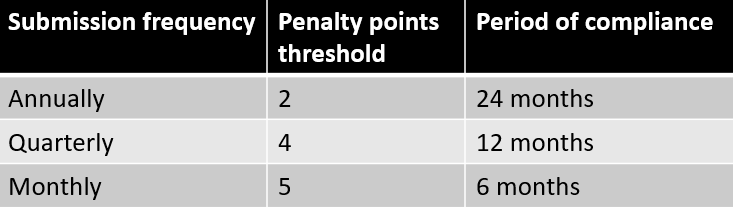

Once your penalty threshold is reached – see table below for thresholds, depending on your submission frequency – you will receive a £200 penalty and a further £200 penalty for each subsequent late submission.

You will be able to reset your points back to zero if you:

- submit your returns on or before the due date for your period of compliance — this will be based on your submission frequency

- make sure all outstanding returns due for the previous 24 months have been received by HMRC

Paying your VAT late

Late payment penalties will work on a percentage basis, and it is best to pay sooner for a lower penalty rate.

For outstanding VAT up to 15 days overdue, you will not be charged a penalty if you pay in full, or agree a payment plan, on or between days 1 and 15.

VAT overdue by 16-30 days will incur a first penalty calculated at 2% of the outstanding VAT owed at Day 15.

If your VAT remains outstanding over 31 days, and no payment plan is in place, you will receive the first penalty as above, plus 2% of the VAT you owe at Day 30.

In addition, you will incur a second penalty at a daily rate of 4% per year for the duration of the outstanding balance, which will be calculated when the balance is paid in full, or a payment plan is agree.

Late Payment Interest

From 1st January 2023, HMRC will charge late payment interest from the day your payment becomes overdue, until the that it is paid in full. The interest will be calculated as the Bank of England base rate plus 2.5%.

Familiarisation period

There will be a familiarisation period for the above changes, where HMRC will not be charging a first late payment penalty for the first year from 1 January 2023 until 31 December 2023, provided you pay in full within 30 days of your payment due date.

In Summary

It is important to remember that you should file your VAT return on time to avoid incurring penalties. And if you feel that you will have a problem paying the VAT owed, then ensure you set up a payment plan with HMRC, which will prevent unnecessary interest payments – even if you have not paid, if you have set up a plan within the first 15 days, then you will not incur interest payments.

If you need any help or further information, please contact us.