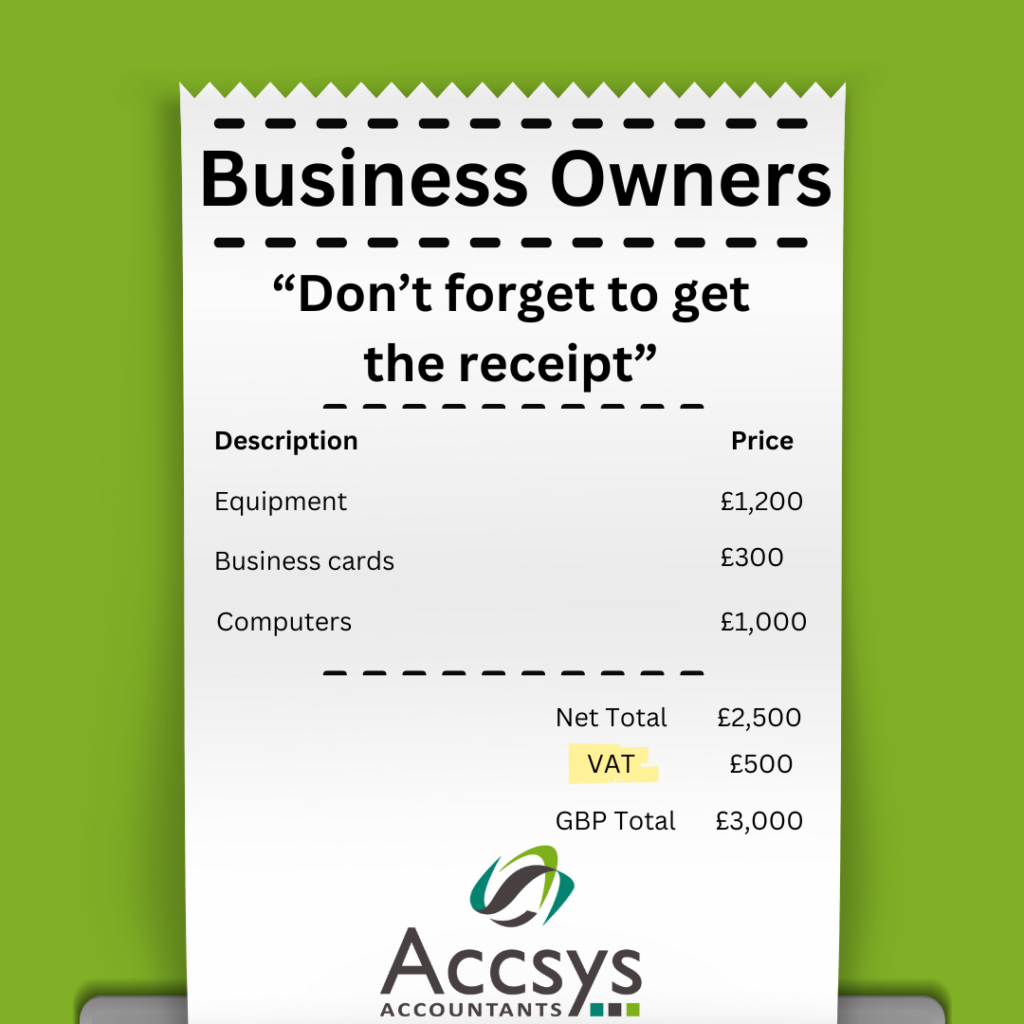

Business owners must have a love-hate relationship with receipts. On the one hand they are a pain in the backside always having to remember to get them and keep them safe, taking up valuable space in your wallet or the door pocket of many vans. On the other hand, they are the beginning of the process towards saving money.

If you are VAT registered, you can’t get the VAT back without a valid VAT receipt and also can’t have the tax back. But what does this mean?

Imagine you just purchased a piece of equipment for £1200 including the VAT – there is £200 in this cost that you will get back on your VAT. Plus, you can reduce your Tax. So, depending on how profitable you you could get up to an additional £250 back on this purchase.

Suddenly, the receipt sitting at the bottom of your bag or on the floor of your van, is more than just the annoying piece of paper that the bookkeeper asks you to keep hold of…it could be worth up to £450 to you. Imagine if you actually had £450 cash in an envelope, you would treat it carefully and wouldn’t risk losing it. Receipts should be no different.

So, receipts are important as they represent real savings, but what represents a valid VAT receipt?

A valid VAT receipt should include all the following details:

- A unique invoice number

- The seller’s name or trading name and address

- The seller’s VAT registration number

- The invoice date

- The tax date

- Your name or trading name and address

- A description of the goods or services supplied to you

Simplified VAT receipts

VAT receipts with all of the above detail are not always necessary. Retailers can issue less detailed invoices for sales under £250 (including VAT) and are not required to issue an invoice unless the customer requests it. These need only show:

- The seller’s name and address

- The seller’s VAT registration number

- The date of supply (tax point)

- A description of the goods or services supplied

- The total price including VAT

- The VAT rate applicable to the item

All this means is that an order confirmation, order acknowledgement or a credit card receipt are not enough to reclaim the VAT.

So, look after the receipts! They are worth their weight in cash and not only allow your bookkeeper to do keep your books more effectively, but also means they can claim what you and your business are entitled to.