- Credit Control

A good credit control system is worth its weight in gold. The system doesn’t have to be over-complicated; it simply needs to be systematic and capable of applying increasing pressure on the late-paying customers without upsetting the good ones.

If you haven’t got these steps in place in your credit control system, then these are the essential starting points:

- It is a good idea if only one person is responsible for credit control.

- Make sure you have an aged debtors report (a report showing the relative age of each of your outstanding invoices), so you know whom to chase first. Most computerised bookkeeping packages will do this for you. If you aren’t using one, then get one.

- Print a list of debtors at the beginning of each week and make a note to which debtors you are going to either:

- Call

- Send a statement

- Send a letter, which should increase in severity, from the first letter enclosing a statement, to the last letter threatening legal action.

- Record everything you do, on what date, and make a note of all payment promises the debtors to make.

- Remember you are entitled to charge interest on overdue debts; so don’t be afraid to mention this in the letters.

- As a last resort, contact your solicitor to issue a solicitor’s undertaking, to inform the debtor of intended legal action. Solicitors letter are a cheap way of warning a customer to pay and showing them you are serious about collecting your debt.

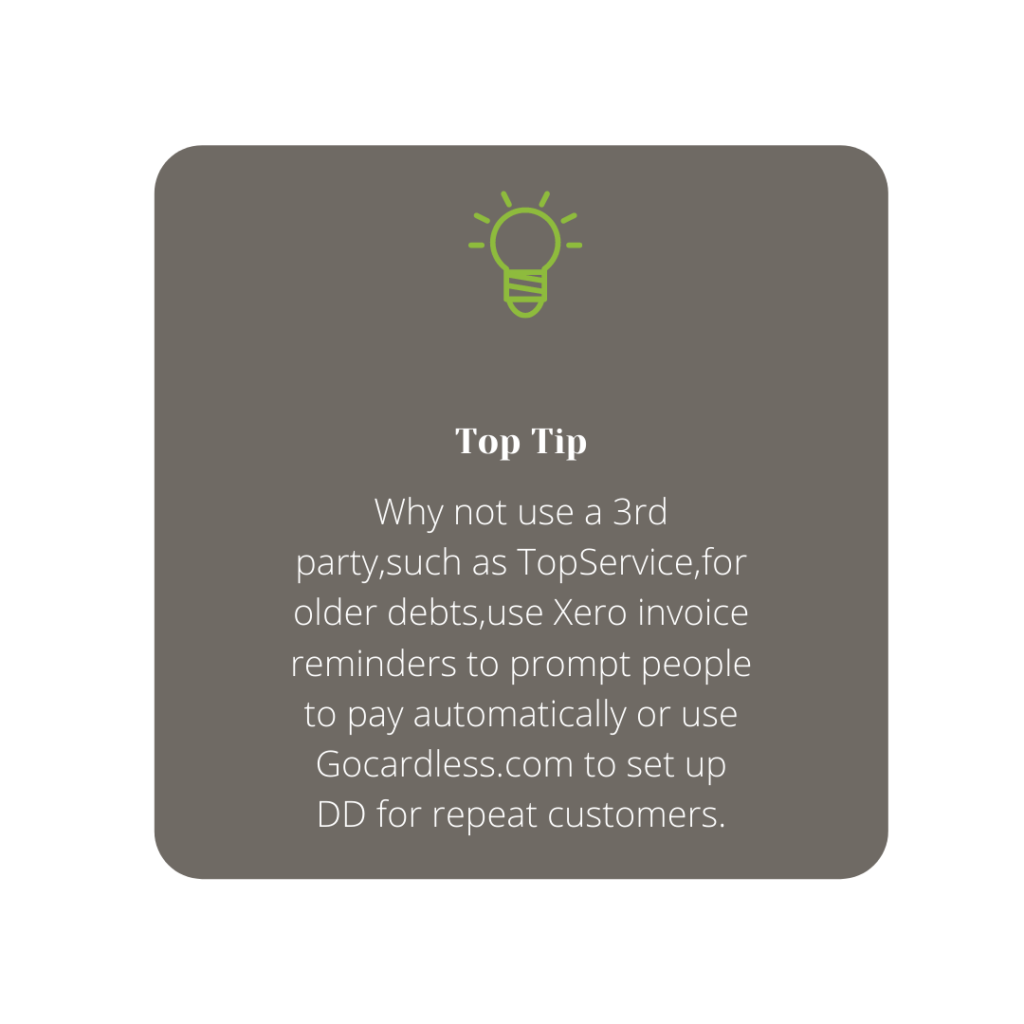

SOFTWARE TIP: Xero is our preferred bookkeeping software, and it has several functions that help with credit control. Firstly, it produces statements easily and quickly, which can be emailed directly from the software. This saves a few seconds for each statement. You can keep notes on each contact so you can record the payment promises debtors make.

Finally, don’t forget a good customer who doesn’t pay you is not a good customer, so don’t be afraid of upsetting them by increasing the pressure you bear on them over their debts.