Blogs

The Benefit of Budgeting – Xero Features Explored

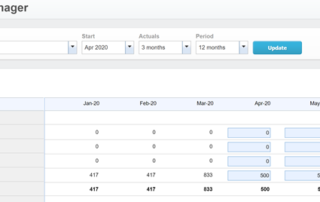

Xero has some great features, that are included in the fee you pay, but are not often used as they are not part of the core product [...]

Individual Tax Planning: Things to do when approaching the end of a tax year

As we approach the end of another tax year, its time to consider the things you should be doing to ensure you don’t lose out on the allowances [...]

Today’s Budget Announcements

After listening carefully to the Budget today, we can report on the headline announcements and how they affect you as a business owner. As usual, the detailed nuances will become [...]

Salary Sacrifice…What Is It, How Does It Work and Is It Worth It?

Salary sacrifice is an agreement to reduce an employee’s entitlement to cash pay, usually in return for a non-cash benefit, such as providing the employee with an asset [...]

THE DIVIDENDS TRAP – How Dividends Can Cause You A Problem

For many years, the standard advice from accountants has been for Directors to pay themselves a salary and for shareholders to take dividends. Often in small companies, the [...]

Further Government Help for Businesses due to COVID-19

Information has been published by HMRC concerning the process for repaying VAT deferred by businesses during the first lockdown. To defer your payments, you will have to opt [...]

Should I register for VAT?

VAT, or Value Added Tax, is known as a sales tax because it’s added to the sales your business makes. Most businesses can reclaim the VAT they suffer, [...]

Reverse charge VAT for CIS construction services

If you are CIS registered and VAT registered, then from the 1st of March 2021 there will be changes to the way you account for VAT. This blog [...]

Fines And Penalties – What To Be Aware Of When Running A Business?

HMRC collected £1.4 billion in fines and penalties in the year to 31st March 2020. These are entirely avoidable penalties for late tax returns, unpaid tax etc. Companies [...]

How To Incentivise Key Employees By Gifting Them Shares

One of our most frequently asked questions is “Can I give shares to key employees? And what are the tax implications of this?” Why do you want to [...]

Happy New Year – Let’s get going (despite the lockdown)

I cannot think of a more challenging way of starting a new year than with a total national lockdown. Running a business just got a whole lot harder. [...]

Company Car-is it time to go electric?

Company cars are an easy target for HMRC – people need a car, and they often desire an expensive one! So maybe it’s time to ditch the petrol [...]

How should I own my rental property – Personally or in a Ltd Company?

Whether you are a professional or a reluctant landlord, many people are unsure of the tax implications of owning their property in a limited company and whether this [...]

If you employ people – Do you have an IR35 problem?

HMRC want all people you “employ” to be on your payroll and for taxes to be deducted from them at source and paid over each month. The reality [...]

Furlough or Redundancy – The harsh decision facing businesses this Christmas

As the new tier system kicks in, many businesses are finding themselves facing tough times and some very difficult decisions this Christmas. Over the last six months, you [...]

BREXIT – Are you ready for VAT and customs duty requirements from 1st Jan 21?

The UK/EU withdrawal agreement expires at 11pm GMT on 31 December 2020. After that date, the UK will become a separate customs territory from the EU. This means [...]

HOW LIKELY IS A TAX INVESTIGATION?

One of the perpetual fears of many business owners is HMRC. Sometimes this is an irrational fear and sometimes it justified. HMRC have enormous powers that seemingly increase [...]

What is the best trading structure for my new business

One of the first decisions that you will need to make when you start a business… What is the best trading structure for my new business? Which legal [...]

Accountants have changed – How we add value to our clients!

In the not to distant past, accountants used to be someone you interacted with once a year when you dropped off your books and then sat down with [...]

Warning Companies house are stopping paper reminders!

Companies house have announced that from Monday 9th of November they will no longer sending paper reminders for important deadlines. An example would be dates on when a [...]

Ways to reduce your Inheritance Tax

In a taxes popularity contest, Inheritance Tax would be in last place! Also known as the Death Tax, Inheritance Tax (IHT) is a tax you pay on the [...]

Landlord Taxes Explained

Owning and renting out houses has traditionally been a good way to supplement your income. In fact, it had been so popular that the government has tried to [...]

Tax efficient ways of getting paid from your company

A Limited Company is arguably the most tax efficient structure to run your business through, but there are hidden tax traps that are easy to fall into. The [...]

Tax relief your employees can claim for working from home

Increasingly, employers are asking employees to work from home. However, this comes with additional household costs for them. Nevertheless, there is tax relief available. The additional costs your [...]

Capital Gains on Property – You have 30 days to pay the tax

If you are a landlord, second homeowner or a holiday homeowner and you sell your property at a gain, you have just 30 calendar days to inform HMRC and [...]