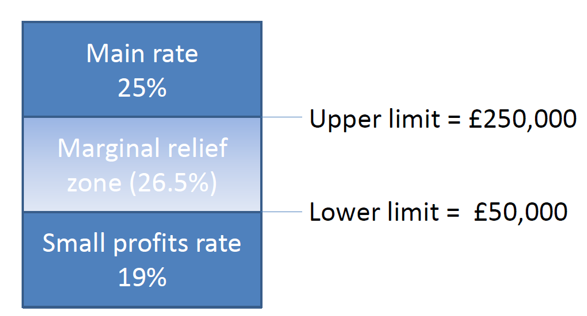

Corporation Tax is now taxed in bands. As the image below shows, profits above £250k are taxed at 25%, those below £50k at 19% and profits that fall in between are taxed at a hybrid rate of the two. But these bands are reduced by the number of companies that each Limited Company is associated with.

What is an associated company?

A company is an ‘associated company’ of another company if one company has control of the other, or both are under common control ie. the same person, or persons.

A person is treated as having control over a company if that person exercises, is able to exercise, or is entitled to acquire, direct or indirect control of the company’s affairs.

In particular, a person is treated as having control of a company if the person possesses or is entitled to acquire:

- the greater part of the share capital or issued share capital of the company;

- the greater part of the voting power in the company;

- so much of the issued share capital of the company as would, on the assumption that the whole of the income of the company were distributed among participators, entitle that person to receive the greater amount so distributed; or

- such rights as would entitle that person, in the event of the winding up of the company or in any other circumstances, to receive the greater part of the assets of the company which would then be available for distribution among the participators.

A simple example of an associated company

John has two companies, Hello Ltd and Goodbye Ltd. He is the only shareholder in each. Both companies are under his control and consequently, are associated with each other.

So how does an associated company affect your Corporation Tax?

Let’s say for example, your company has profits of £40,000. If it had no associated companies, then it would pay corporation tax at 19%. But with 1 associated company, it would pay tax in the Marginal Relief Zone, because the bands have been reduced and, in this example, the lower limit is now £25,000 and which puts the company above the lower band.

The 2nd company is ignored if it is a passive holding or dormant company.

Unfortunately, a fair few of our clients do not have such a simple structure with associated companies, so we will be monitoring and applying these rules carefully as we move forward. This might be worth considering if you are about to start another limited company because this may push both companies into a higher tax rate. Please speak to us if you have any concerns.